Over at the Scorpio Partnership, they’ve been busy researching the ‘Futurewealthy’, looking at how these guys (and girls) think. Specifically, what technology means to them, how they use it today and how this will change in the future. Of particular interest to us here on the Kurtosys blog, is their focus on communication.

The Futurewealthy, it seems, believe that the internet has a key role to play in their wealth creation – whether that’s through marketing, buying or selling, building networks or communicating – but it’s communication that tops the list of opportunities presented by the web.

Source: The digital world of the Futurewealthy: Scorpiopartnership Nov 12

Communication has changed beyond recognition over thousands of years

New technologies have come and gone and written communications have been through a particular metamorphosis. From cave paintings to hieroglyphic carvings, slate to paper, word processors to PCs and now, here we are today with a plethora of Smartphones, tablets and an ever expanding internet. Businesses have adopted all of these technologies and harnessed them to improve communications. And those that have done it speedily and successfully have been the winners in their industry.

Today, there are more ways than ever to communicate with your clients

Old fashioned face to face communication, phone calls and putting pen to paper are still valued. But email is king. Then there’s social media, text messaging, instant messaging, secure web portals and VoIP (Voice over Internet Protocols such as Skype). As a business serving the Futurewealthy, you need to be able to embrace the opportunities these mediums present.

Many potential clients are already embracing new communication technologies…

With more than ninety percent of the wealthiest Futurewealthy believing the internet will play a role in their ongoing success, they’re spending a significant proportion of time online.

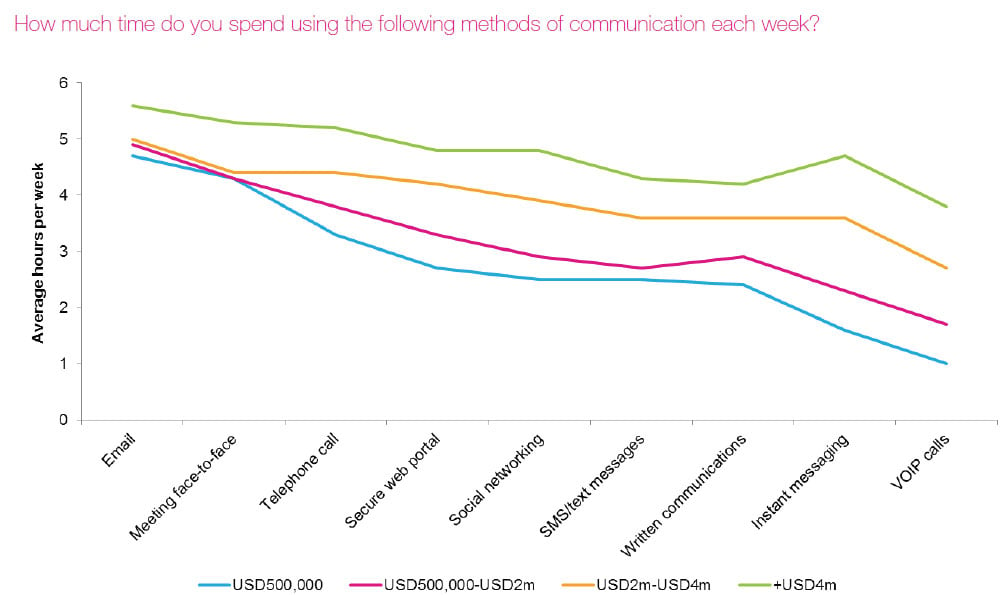

Source: Stepping into the communication age: Scorpiopartnership Jan 13

What’s interesting to note here is that the uber-wealthy are the early adopters; already spending circa 5 hours per week in a secure web portal, 5 hours per week instant messaging and 5 hours a week social networking.

Not only that, the wealthiest are also communicating significantly more overall than their less wealthy counterparts. In total, the study shows those with over $4m devote almost 43 hours a week to corresponding one way or another (compared to 25 hours per week for those with less than $500k) – who knows when they sleep!

And they intend to do this more!

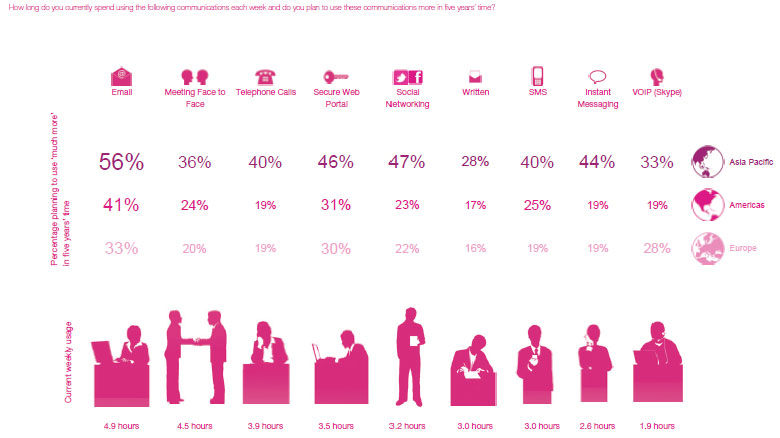

Source: Stepping into the communication age: Scorpiopartnership Jan 13

Without exception, all regions participating in the survey believed they would communicate ‘much more’ across all communication methods in their professional and personal lives. But surely, clients won’t expect large investment institutions to be at the cutting edge of these technologies… will they? Oh yes they will.

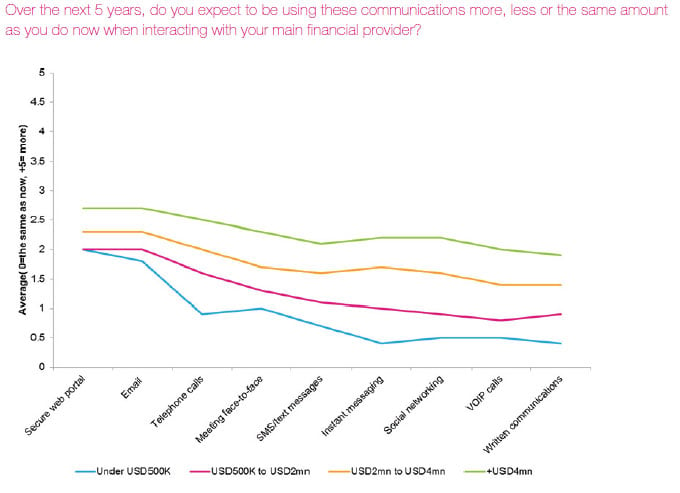

The Futurewealthy expect to use these technologies when interacting with their main financial providers

Source: Stepping into the communication age: Scorpiopartnership Jan 13

Again, the anticipated growth in email usage and secure web portals should be noted – particularly when focussing on the most wealthy segments. Current conventions might suggest that these clients are the ones who would prefer a face to face meeting. Whilst this is still valued, wealth managers who ignore new technologies are unlikely to attract this client base. This is also of particular relevance for firms operating in the techno-savvy Asia Pacific region.

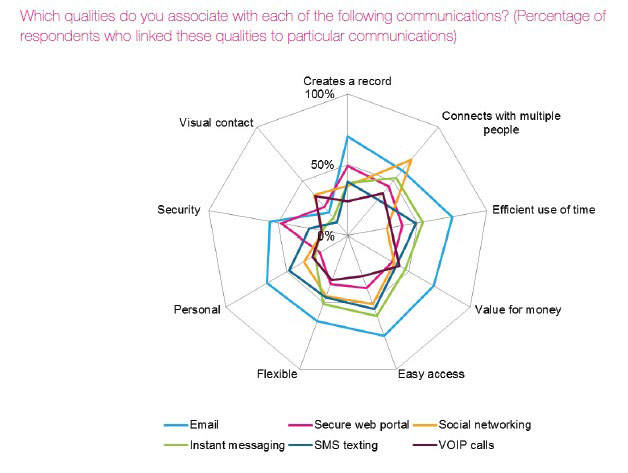

Emails are favoured due to their multiple benefits

They’re secure and personal but with an ability to talk to several people at once. Not only that, they’re accessible, cheap and create a lasting record of a discussion. Emails are only surpassed by social networking’s ability to connect with multiple people and by face to face meetings. Person to person contact is still valued for its personal nature and for the visual contact; clients still like to look advisors in the eye – particularly when establishing trust.

Source: Stepping into the communication age: Scorpiopartnership Jan 13

The demand for secure web portals is also growing as the functionality of such portals improves. That’s one of our strengths here at Kurtosys. We design with the client in mind; pulling in the relevant data, keeping it secure (obviously), simple and compatible with the chosen device – ultimately providing asset managers with tools their clients won’t want to be without.

The demand for new communication channels is being driven by a range of factors, including the economic crisis, a desire for efficiency & technological improvements.

The recession has led many business and individuals to re-examine their way of working and investing. There’s a greater need for transparency, for regular communications and for discussion. But there is less time! Face to face meetings are inefficient and time spent travelling can be better utilised elsewhere – so clients turn to emails.

The economic crisis has also created nervousness, fear and scepticism so clients seek advice from multiple sources; websites, forums and other social media. And there’s an increased desire for keeping an eye on investment performance; tracking it more frequently. And so secure web based portals start to come into their own.

Improvements in technology, particularly the usability of mobile devices, has made sometimes exclusive, sometimes cumbersome applications very, very accessible. And the cost continues to fall making them yet more readily available. With an application for almost everything and the ability for this to be available at your fingertips, is it any wonder new communication methods are thriving?

Wealth Managers optimising their communications strategy across the broad spectrum of traditional and modern methods, should increase their attractiveness to High Net Worth clients

The world’s elite expect to communicate more; in more forms and more often. All this suggests that firms wanting to connect with the Futurewealthy, will need a wider repertoire of communication styles as well as a broad technological toolkit.