The way we consume information has been reinvented since the relatively recent development of smartphones. The appetite for apps is stronger than ever, people are increasingly using tablets for business purposes, and smartwatches look set to be the next growth area — raising new challenges for businesses when presenting information about themselves. Some asset management firms have embraced such developments, and others must follow or risk demise.

The publishing sector has perhaps been the most obvious casualty of these rapid changes. Media companies have been forced to adapt quickly to the new era, moving their attention away from their print offerings towards mobile and digital products in a mad scramble to remain relevant and profitable.

As well as this evolution in the way we access information, a fundamental shift is underway in the relationship between businesses and their customers. The rise of social media was the first evidence of this. People now expect to be able to interact directly with the corporations that serve them – a complaint on a public forum like Twitter, for example, almost guarantees a rapid resolution. Consequently, asset managers are now realising the need to put resources behind their customer service via these channels.

But the trend towards direct interaction poses particular problems for the heavily regulated asset management industry, which has traditionally used intermediaries as the bridge between firms and their clients. Today, the relationship between private investors, advisers, wealth managers, and fund groups is no longer as clear cut and linear as it once was.

The digital impact on the financial services industry

Increasingly, people don’t want to outsource the running of their pot of cash to an intermediary and never think about it again. They want to know how their money is invested, and have greater input into these decisions. This growing engagement with financial matters is perhaps the only positive to come out of the financial crisis, and also reflects the dramatically changing landscape for pensions and savings. This has paved the way for the arrival of online B2C investment firms like Nutmeg, which offers low cost, passive-based discretionary portfolios, targeting both sophisticated investors and less experienced ones who simply want more control over their investment decisions. Although Nutmeg is not expected to be profitable until 2016-17, its high profile backers including Schroders suggest the industry thinks this model is here to stay, and could be set for exponential growth in later years.

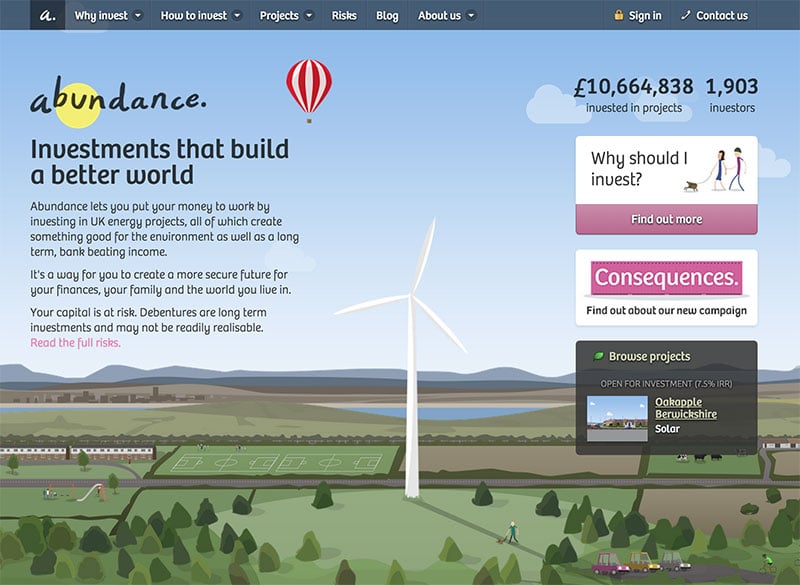

Hargreaves Lansdown recently brought its own offering to the table in the same vein, giving customers direct access to ready made portfolios through its Portfolio Plus service. Renewable energy investment platform Abundance has also been gaining ground – the service allows private investors to back energy projects through debentures bought directly through its website.

A survey conducted in 2014 by Capgemini and RBC Wealth Management found that, globally, 65% of high net worth individuals expect to run most or all of their wealth relationships digitally in the next five years [Read: 8 Impressive Stats About Digital Client Engagement]. And this trend is not restricted to HNWIs directing their own portfolios – the research found that even advice-seeking investors expect their relationships to be primarily digital in the future.

Banks have been quick to respond to this demand, developing hi-tech, user friendly apps and more direct lines of communication such as secure messaging and live chat tools which connect them to their customers.

What are fund groups doing?

Primarily, fund groups are making big investments in their digital content strategy – but some, in so called “stealth mode” are building out their own variant of a direct to market proposition and looking at recent regulatory changes such as workplace pensions as foundations for these offerings.

Fund factsheets, for example, are often the first port of call for potential investors wanting to get an overview of a particular portfolio and what it does. They also want to be able to look at performance and compare a single product to another. They demand this information in a format, which is clear and readable through whichever channel they choose, is interactive, and can be downloaded and stored for future reference.

Given the volume of detailed information on the website of a typical FTSE 100 asset manager, for example, the implications of meeting such a challenge are huge, and could be costly. But the winners in this competitive market will be the firms, which move quickly to give their customers what they expect, and no longer try to remain at arm’s length from the end user in a rapidly evolving marketplace.