It’s generally a good idea for governments and public bodies to stay out of private sector innovation – they may be able to help nurture an environment that is supportive to new ideas and ventures, but they’re rarely best-placed to take the lead. The strange case of the pensions dashboard, however, might be a rare exception; the UK Treasury’s move to demand that such a tool is available to consumers by 2019 rather begs the question of why we’re not there already.

We have had, after all, online fund platforms for several years now – these give people an opportunity to look at all their investments on a single screen, and to use a variety of sophisticated tools to analyse their holdings in order to identify potentially better outcomes. Can it really be so hard to build a platform that enables pension savers to do the same thing with all of their pension plans?

There are additional complications, of course. Not least, different types of pension provider come to the debate with very different mindsets. The large life insurers and pension providers are competing with one another to win business from individual savers. Workplace pension scheme providers are trying to run affordable but attractive plans for particular groups of investors. And then there’s state provision to take into account too.

In fact, the UK’s Department for Work and Pensions estimates that, on average, people will have 11 different pension pots as they approach retirement. But while building a dashboard that provides a single source of data on each of these funds represents a challenge, the technical issues are far from insurmountable. The bigger issue may be to persuade those likely to bear the brunt of doing the work that this is a worthwhile opportunity.

For consumers, the attractions are obvious. The fragmented nature of people’s pensions savings mean that most people have little idea of how well – or not – their planning for retirement is proceeding. Complexity and opacity acts as a disincentive to further saving. And those who do make active decisions about how to save and invest for the future are invariably doing so on the basis of incomplete information.

What’s in the dashboards for the pensions industry, however – and particularly the life and pensions sector, which will inevitably have to do most of the heavy lifting in building a dashboard based on common standards and interoperability, while remaining acutely conscious of data privacy and security?

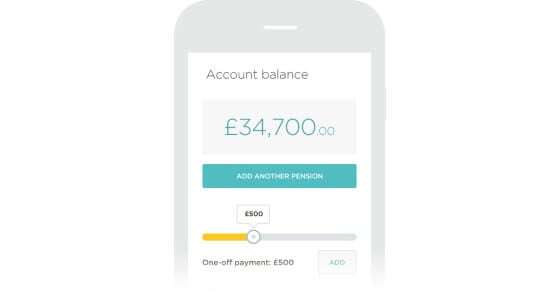

Well, you can start to see the potential opportunities from the limited services that are already available. Start-up business such as MyFutureNow and PensionsBee are already offering small-scale dashboards with the hope that once they’ve got savers’ data in one place, they’ll be able to sell them services such as consolidation.

Well, you can start to see the potential opportunities from the limited services that are already available. Start-up business such as MyFutureNow and PensionsBee are already offering small-scale dashboards with the hope that once they’ve got savers’ data in one place, they’ll be able to sell them services such as consolidation.

That’s likely to be just the start. After all, investors who are able to take control of their pension planning are much more likely to feel confident contributing larger sums to their savings – to the benefit of their pension providers. In workplace schemes, meanwhile, the burden of communication is a continual struggle for employers – dashboards offer new ways to keep in touch with members through automated processes.

The lessons from other parts of financial services are clear. Online and mobile banking, for example, are making it much easier for people to keep track of their personal finances, and have high levels of engagement. Fund platforms have become the default option for thousands of investors managing their money online. Asset managers increasingly operate through user-friendly, transparent and accessible portals. In all of these examples, consumers are better informed and more active participants – to the advantage of product and service providers competing for their business.