At Kurtosys, we think so.

For the past four years, we have completely reimagined how financial services firms need to respond to the unstoppable force of digital transformation. Simply put, digital transformation means using technology to change the business model. What stands at the very beginning of digital transformation is the entire value chain of customer experience. At Kurtosys, we believe that the technology market for self-serve, cloud enabled platforms for financial services firms to build superior customer experiences remains weak, if not non-existent. This has led us to focus on finding better ways to help sales, marketing, distribution and client servicing functions to provide their communities with a brand experience like never before. Meanwhile, the financial services industry have themselves had deep introspection of their own businesses. Having invested significantly on operational efficiencies, they are now looking with renewed interest at improving the client experience across the pre-sales to post-sales life cycle.

It has been a very productive few years for both Kurtosys and the financial services industry. Mindsets have changed and cloud technology has come of age. The industry has awakened to the possibility of digital and, in parallel, we have developed an experience platform that meets the needs of modern day sales-to-service business models. Whilst we take nothing away from some (perhaps more exciting) areas of fintech such as robo-advisory, payments, regtech and blockchain, we have a concerted mission at Kurtosys to help our customers transform sales and marketing, by becoming more agile and responsive to their clients and prospects in a way they have previously been unable, largely because of “legacy” tech.

Our mission has been about innovation, disrupting processes that have been embedded in the industry for decades, and practices that have become the norm through entrenched technologies of yesteryear. When Henry Ford brought along the car he changed the norm, as did Steve Jobs when he gave us the iPhone and iPad. Only when a new technology approach arrives is the norm challenged.

Our claim is that the Kurtosys Experience Platform does change the norm by challenging existing technology vendors whose products no longer support the velocity, or have been poorly designed in supporting financial services firms to operate modern day sales-to-service models.

The last four years has seen us investing heavily to bring to market a “cloud first” experience platform, built for financial services by financial services practitioners. So, what is it exactly that we are changing that we don’t think exists in a convincing way today? We see three keys aspects.

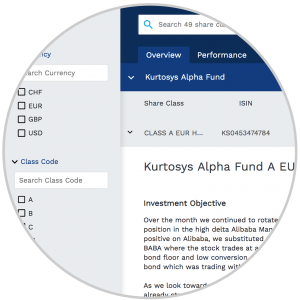

Firstly, our customers need a single data/content platform to drive their websites, post sales experiences, sales portals, marketing documents and sales presentations. Couple with this the need for deep marketing analytics. Who looked at what, and when.

Secondly, our customers need a low code/codeless user interface where they can build beautiful experiences, with drag and drop functionality, create integrations with marketing clouds, translation services, media providers, etc. They needed to configure data driven product pages, product finders and drill down tools without the need to have lengthy, developer heavy projects.

Thirdly, and crucially, our customers needed a cloud-first approach that satisfies and observes the stringent requirements for security, resilience, back up and disaster recovery. Furthermore, they need serverless infrastructure that auto-scales, is constantly self-monitoring, and satisfies the need of technology departments who requires access to log, audits and infrastructure monitoring.

Why do we feel the industry needs these things? Time, cost and resource: quite simply, our customers have much less of all three. Competition, regulations, consolidations and importance of brand/positioning has forced the agenda. This is bad news for the “norm” vendors. Without exception, the existing Digital Experience Management (DXM) market is held up by vendors that have complicated pricing models (that can give you big surprises), require a lot of development resource to actually work, and don’t support the many infrastructure services that our customers need integrated into their platforms. The norm is no longer acceptable.

In launching the next release of our platform, Kurtosys is bringing to market a proposition which is based on over 20 years of in-depth experience working in financial services. We feel we are bringing a technology that can give our customers an agile, user friendly and rapid response platform for transforming their client servicing capabilities without the need for large, labour intensive implementation projects. In launching our platform, we have placed particular emphasis and engineering investment on:

Cloud-First: Designed for the cloud, an architecture that not only scales, but can be provisioned instantly and monitored constantly. It leverages the very highest standards offered in cloud security and ensures our customers are taking advantage of enterprise grade technology for ensuring that their digital channels are fast, responsive, resilient and able to touch every potential or existing customers in every corner of the world.

User Driven Tools: Pre-tooled for marketers, channel support and client service teams to build their own digital experiences – pre-sales, post-sales and sales support – by themselves. No code, no long implementation timescales, and no hidden or unpredictable costs.

Business ready: Full of the apps that you will need to drive your digital business, including marketing analytics, SEO management, customized business widgets, components to support secure login processes and protect content, and personalization and customization of content.

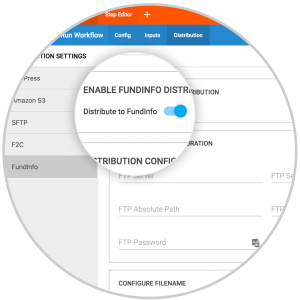

Integrations: API-based integrations with marketing clouds, CRMs, video services, chatrooms, bots and other industry specific services. Documents: Template management, component design, drag and drop, multi-document type including Microsoft PowerPoint/Word/Excel, and PDF with omni-channel document distribution including e-mail, SFTP and integrations to industry marketplaces and information venues.

Documents: Template management, component design, drag and drop, multi-document type including Microsoft PowerPoint/Word/Excel, and PDF with omni-channel document distribution including e-mail, SFTP and integrations to industry marketplaces and information venues.

So, yes, financial services does need a better Experience solution. One which offers speed to market, codeless customization, digital and document duality and integrations across the enterprise and third parties.