1. Go back to the future

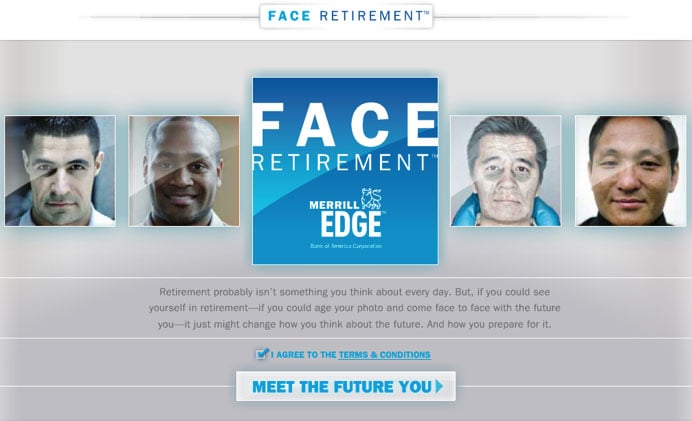

How would you like to meet the future you? That’s exactly what the Face Retirement tool from Merrill Edge (Bank of America) lets you do.

Their “behavioral time machine” is one of several solutions designed to make it easier for investors to connect with their future selves. Anyone who has tried to resist that last piece of candy in an attempt to control an expanding waistline will know that it is not always easy to do something today that will help you tomorrow.

This difficulty with imagining the future is one of the key barriers to long-term saving. Being able to literally visualize one’s future self helps overcome this problem to the extent that in experiments volunteers who saw their future selves more than doubled the amount of money they said they’d allocate to retirement savings.[i]

2. Encourage play

A fund illustrations tool that can show advisors and their clients the returns they might expect from their investments is another great way to help visualize the impact of saving more or less for the future.

Fund Illustration tools are particularly useful for advisors whose clients want to see a range of scenarios or even play with the inputs and vary the outcomes themselves. Adding a tool that can produce illustrations for multiple funds, email the results out to clients or advisors, and then download a PDF for record keeping is a simple but powerful way to drive client conversations.

Jupiter’s client illustration tool for financial advisers and wealth managers

3. Try the Save More Tomorrow (SMarT) Program

The basic idea of the Save More Tomorrow program is to stop asking people to save more today, and instead ask them to save more in the future instead.

The program was developed by researchers Shlomo Benartzi and Richard Thaler and tested on retirement plan participants, you can read the full results of their study here.

In the experiment, participants were asked to increase their savings rate by 3%.

Whilst only 28% of employees agreed to an instant increase, the majority (78%) signed up to increase their savings by 3% per year in the future.

I hear you: “Yes, but what really happened?”

Well, only 2% of participants dropped out after a year and even four years later, 80% of them were still on track. After those four years, those taking part in the trial had boosted their savings rate from 3.5% to 13.6%, a pretty impressive result when compared to the control group who rose from 4.4% to 8.8%.

To find out more, get the book Save More Tomorrow by Shlomo Benartzi or watch his TED Talk shared below:

4. Bring out the buckets

Research shows that most of us indulge in “mental accounting,” or dividing up our money into separate mental “buckets.” For example, you might have a bucket for travel, dining out or clothes. Mental accounting can help people to control their spending, and a similar idea, “earmarking” has been shown to have a dramatic impact on retirement saving.

A study – explained in detail in this great white paper from the Allianz Global Investors Center for Behavioral Finance – showed that earmarking savings in an envelope labeled with a picture of a couple’s children nearly doubled the savings rate of very low income parents.

Of course, most financial advice is aimed at high net worth investors rather than low income parents but nevertheless, George Lowenstein of Carnegie Mellon University believes that applying bucketing and earmarking to retirement planning can help clients with risk management. Whilst one bucket is given an aggressive growth strategy, another might be more cautious. By matching these up to the actual purpose of that money, investors become more comfortable making sound decisions.

Helping clients make rational decisions

Certainly, what links all four of these suggestions is the idea that today’s financial advisers – and therefore, today’s asset managers and fund providers – really do have an important role to play in helping clients make rational decisions, even as their own built-in irrationality tries to convince them to focus on the here and now.

And as we’ve hopefully shown above, it doesn’t have to be complex. Embedding an interactive client illustration tool on your website, for example, is a quick and simple way to begin helping advisers and the investors they serve get to grips with imagining the future. After that, who knows where the behavioral finance journey might take you.