Firstly, I’d like to start with a disclosure: This blog is not about the legal interpretation of MiFID or an analysis of the detailed prose of the directive and associated legislation. If you do want to access the details, including the next enactment of the directive (which now comes into effect on January 2018) the documents can be downloaded from the ESMA website. Be warned, these materials are by no means light reading.

In addition, pretty much every legal and professional service firm involved in financial services has in-depth technical commentary on what MiFID II Level 2 will bring us. Until recently Kurtosys has been involved in MiFID somewhat from the sidelines. But now, it’s time for us to reveal our interest in this significant – perhaps ground breaking – phase of financial reform which will undoubtedly change the investments and advisory space forever.

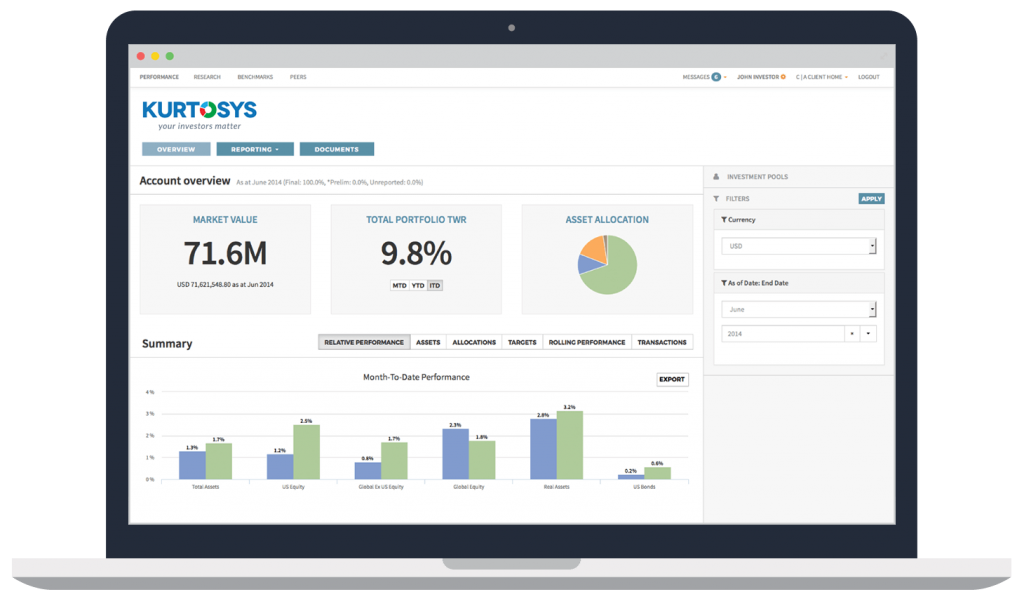

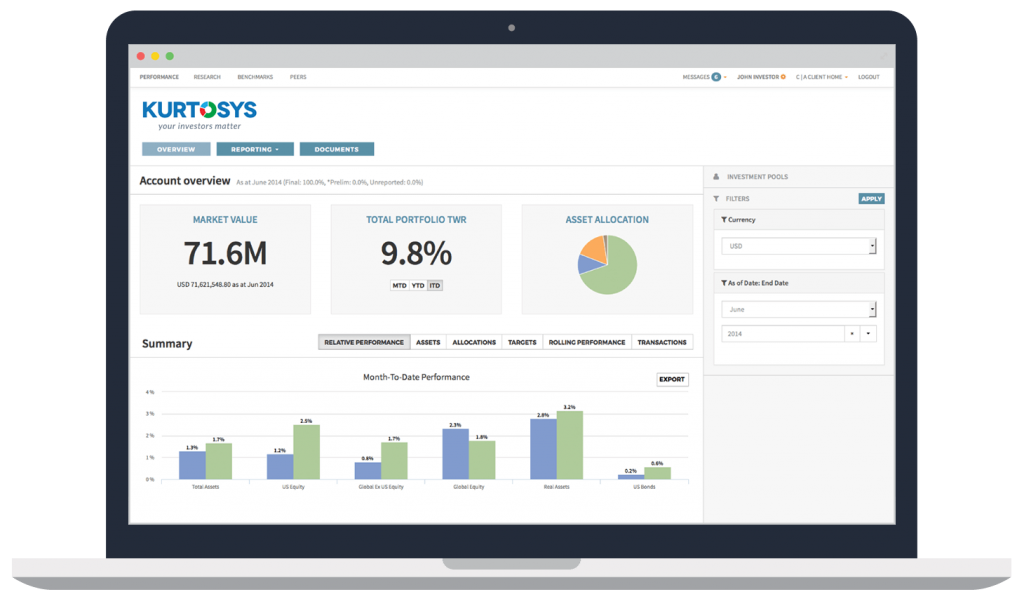

Most of our readers will know that digital change underpins our strategy and product positioning at Kurtosys. One key element of our platform, InvestorPress, is aimed directly at the wealth management area.

Level 2 MiFID has a significant bearing in the wealth management industry and consequently on InvestorPress which is our digital platform for helping our customers – wealth managers and advisors – create a digital channel to their clients. It’s a potentially complex ecosystem, fraught with pitfalls and littered with challenges presented through the MiFID directive.

Furthermore, sales and marketing executives and their teams struggle to demystify all of this and have a coherent way of disaggregrating the legal form so it can become meaningful and practical from a digital perspective. So here’s what we feel should be at least some of the talking points and how “digital” can actually help navigate certain aspects of MiFID:

Most of our readers will know that digital change underpins our strategy and product positioning at Kurtosys. One key element of our platform, InvestorPress, is aimed directly at the wealth management area.

Level 2 MiFID has a significant bearing in the wealth management industry and consequently on InvestorPress which is our digital platform for helping our customers – wealth managers and advisors – create a digital channel to their clients. It’s a potentially complex ecosystem, fraught with pitfalls and littered with challenges presented through the MiFID directive.

Furthermore, sales and marketing executives and their teams struggle to demystify all of this and have a coherent way of disaggregrating the legal form so it can become meaningful and practical from a digital perspective. So here’s what we feel should be at least some of the talking points and how “digital” can actually help navigate certain aspects of MiFID:

The European Union (EU) MiFID II regulations, which come into effect in January 2018, will have a huge impact on the asset management industry. But many managers do not yet have the technological solutions to comply and thrive in the new regime and software providers expect a capacity crunch as investment houses rush to prepare. We look at some of the issues and opportunities.

The European Union (EU) MiFID II regulations, which come into effect in January 2018, will have a huge impact on the asset management industry. But many managers do not yet have the technological solutions to comply and thrive in the new regime and software providers expect a capacity crunch as investment houses rush to prepare. We look at some of the issues and opportunities.

Most of our readers will know that digital change underpins our strategy and product positioning at Kurtosys. One key element of our platform, InvestorPress, is aimed directly at the wealth management area.

Level 2 MiFID has a significant bearing in the wealth management industry and consequently on InvestorPress which is our digital platform for helping our customers – wealth managers and advisors – create a digital channel to their clients. It’s a potentially complex ecosystem, fraught with pitfalls and littered with challenges presented through the MiFID directive.

Furthermore, sales and marketing executives and their teams struggle to demystify all of this and have a coherent way of disaggregrating the legal form so it can become meaningful and practical from a digital perspective. So here’s what we feel should be at least some of the talking points and how “digital” can actually help navigate certain aspects of MiFID:

Most of our readers will know that digital change underpins our strategy and product positioning at Kurtosys. One key element of our platform, InvestorPress, is aimed directly at the wealth management area.

Level 2 MiFID has a significant bearing in the wealth management industry and consequently on InvestorPress which is our digital platform for helping our customers – wealth managers and advisors – create a digital channel to their clients. It’s a potentially complex ecosystem, fraught with pitfalls and littered with challenges presented through the MiFID directive.

Furthermore, sales and marketing executives and their teams struggle to demystify all of this and have a coherent way of disaggregrating the legal form so it can become meaningful and practical from a digital perspective. So here’s what we feel should be at least some of the talking points and how “digital” can actually help navigate certain aspects of MiFID:

Reporting to clients

The concept of “occasional reporting” is being restated such that ALL clients, including professional investors, require a minimal of quarterly reporting with a “fair and balanced” view of undertakings. Investment performance reporting, cost and charges and liquidity guidance also becomes a requirement as does the provision of trade confirmations. The directive suggests that online reporting and document delivery can be a mechanism for over achieving this collection of minimal requirements and allows for the ultimate dispensing of quarterly reports.Information to clients

Quite simply, client disclosures will get close to extreme. Clear and transparent messaging around the independence of advice (or not as it may be), fees, nature of financial investments will all become mandatory disclosures. Also, confirmation of these disclosures needs to be a recorded fact. “Digital” can play its part here. Secure methods of declaring and periodically seeking confirmation from clients can yield big benefits. As can the sharing of key documents that contain these disclosures.Suitability assessment and reporting

Ensuring that initial client agreements are shared and available is a minimum. It is now going to become mandatory for suitability assessments and periodic review thereof to be a compulsory component of the client servicing process. Financial suitability will require strong evidencing – a non-trivial record keeping and management process that will need to be supported and represented through tightly coordinated controls. Again, a digital strategy can help support these processes. Having embedded risk profiling and guided suitability tools within a secure online experience – coupled with automated reminders for reviews- could bring significant efficiencies. There you have it. Three relatively simple areas within the regulation that can be supported by a cohesive and well thought through digital strategy. We make no claims here other than “going digital” could have a profound effect on a wealth manager’s ability to service clients/advisors AND reduce the cost and risk of MiFID. InvestorPress, is a complete end-to-end digital platform for enabling wealth managers to meet all the objectives discussed above and, with the same breath, transform the client experience into a progressive, modern form of wealth management. Watch out, the inbound assets may increase too…that’s what we call a win-win.White Paper: MiFID II for Asset Managers: Threat or Opportunity?

The European Union (EU) MiFID II regulations, which come into effect in January 2018, will have a huge impact on the asset management industry. But many managers do not yet have the technological solutions to comply and thrive in the new regime and software providers expect a capacity crunch as investment houses rush to prepare. We look at some of the issues and opportunities.

The European Union (EU) MiFID II regulations, which come into effect in January 2018, will have a huge impact on the asset management industry. But many managers do not yet have the technological solutions to comply and thrive in the new regime and software providers expect a capacity crunch as investment houses rush to prepare. We look at some of the issues and opportunities.